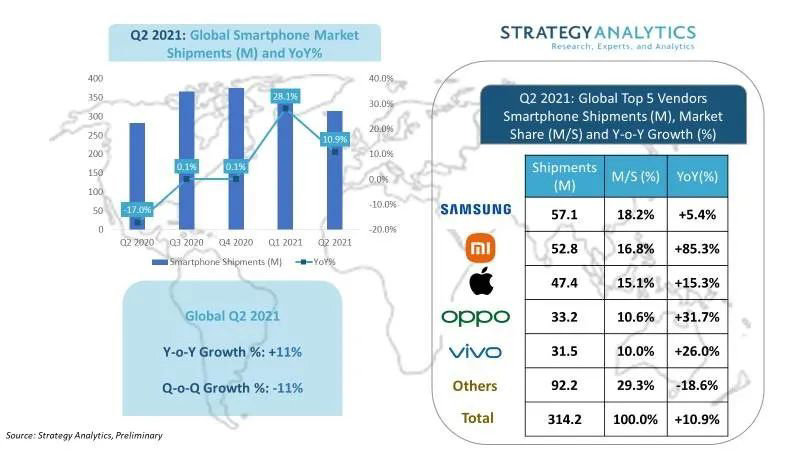

Strategy Analytics has recently released the global smartphone shipments report for the second quarter of 2021. As per the report, the global smartphone shipment is increased by 11% year-on-year to 314.2 million units in Q2.

It should be mentioned that this is the second-highest annual growth rate in recent years (after Q1 of 2021 at 28%). However, due to the second wave of COVID-19 pandemic and supply chains in India and Southeast Asian countries, global smartphone shipments diminished by 11% quarter-on-quarter.

When talking about the smartphone vendors’ position, Xiaomi ranked second for the first time in history. Whereas Samsung leads the smartphone market, Apple ranked third, and Oppo and Vivo gained fourth and fifth position respectively.

JOIN XIAOMI ON TELEGRAM

Xiaomi:

Xiaomi’s global smartphone shipment units are 52.8 million and its market share is 16.8%. Notably, among the top five manufacturers, Xiaomi has the highest annual growth rate (+85.3%).

The tech quickly and successfully captured the aftermath of LG’s withdrawal in Latin America and Huawei’s presence in Europe.

Samsung:

Samsung’s annual growth rate, which is increased by 5.4% year on year was the bottom of the top five vendors. Strategy Analytics believes that tough competition and supply compulsions from Chinese manufacturers have affected Samsung’s performance in the quarter.

Apple:

Apple’s Q2 performance hit a record high. With 47.4 million units shipment of iPhone, the firm is holding 15.1% of the market share. Reportedly, rising markets are playing a frequently important part in Apple’s global map.

We estimate that China has surpassed the United States to become the largest single market for Apple’s iPhone in this quarter. This is the first time in history. The iPhone 12 series supporting 5G continues to be popular with loyal iPhone fans.

Oppo and Vivo:

Other Chinese manufacturers, Oppo and Vivo ranked fourth and fifth with 10.6% and 10.0% market shares respectively. Both manufacturers have witnessed double-digit annual growth rates, mainly from China, India, and other overseas markets.