Earlier today, Canalys published a new report showing smartphone growth in the third quarter of 2021 in Latin America. The report clearly shows that Xiaomi is rapidly growing in Latin America.

Considering the third quarter of 2021, Xiaomi is positioned as the third-largest smartphone brand in the region by shipments. It has a market share of 11%. Notably, in other regions like Puru and Colombia, Xiaomi is sitting in the first and second positions with a market share of 31% and 27% respectively.

JOIN XIAOMI ON TELEGRAM

In early 2017, Xiaomi entered the markets of Colombia, Chile, and Mexico. At that time, the three markets averaged 290,000 units per quarter. Over time, Xiaomi’s strategy in Latin America has undergone tremendous changes since 2019 with the addition of the two markets in Peru and Brazil. In 2019, Xiaomi achieved year-on-year growth of 200% in Colombia and 390% in Mexico.

According to Canalys, in 2019, carrier channels accounted for about 64% of shipments in Latin America. Xiaomi at that time began to focus on carrier channels and integrate channel resources.

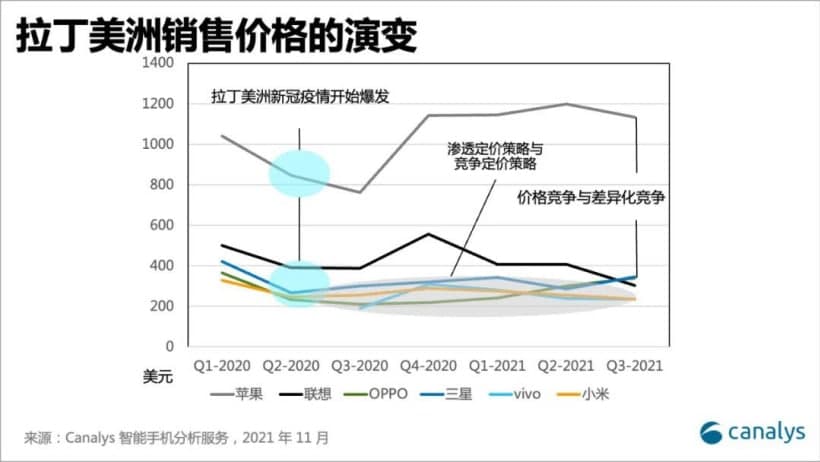

Furthermore, the sales focus of Xiaomi mobile phones has expanded further from the $100-299 price range, with models priced between $100 and $400 and above. Finally, Xiaomi’s shipments to Latin America grew by almost 200% YoY in 19 years.

Whereas, in mid-2020, Xiaomi appointed a new director to lead the business in this area. Xiaomi signed a new alliance agreement with Americas Movil, the largest local operator, to help Xiaomi increase shipments of Colombia by 6500% YoY in Mexican market shipments.

There was an increase of 244%, and shipments to Chile increased by 1610% in volume. Along with this, online and offline retail channel business has also been strengthened.

In addition, Xiaomi’s marketing strategy has prompted Chinese manufacturers such as OPPO, Vivo, and ZTE to enter the Latin American market in what Canalys calls the “millet effect”.

These brands have adopted penetration marketing strategies in recent quarters, starting a price war, and even saturating some price ranges quickly. As of the third quarter of 2021, ZTE had a 4% share, OPPO 3.4%, TCL 2.5%, and Vivo 2% in the Latin American market.